The Governmental Accounting Standards Board (GASB) issued Statement No. 96, Subscription-Based Information Technology Arrangements, on June 5, 2020.

The new guidance is intended to reduce inconsistencies and improve the accounting and financial reporting of subscription-based information technology arrangements (SBITAs).

Key Provisions

Prior to the issuance of Statement No. 96, there was no accounting or financial reporting guidance specifically for government end users of SBITAs. Statement No. 96 establishes a definition for SBITAs and provides guidance on the accounting and financial reporting for such arrangements.

An overview of the new guidance is provided below.

Scope

Statement No. 96 defines a SBITA as a contract that conveys control of the right to use another party’s IT software, alone or in combination with tangible capital assets, as specified in the contract for a period of time in an exchange or exchange-like transaction.

To determine whether a contract conveys control of the right to use the underlying IT assets, a government should assess whether it has both of the following:

- Right to obtain the present service capacity from use of the underlying IT assets as specified in the contract

- Right to determine the nature and manner of use of the underlying IT assets as specified in the contract

Subscription Term

The subscription term is the period during which a government has a noncancellable right to use the underlying IT assets in addition to the following:

- Periods covered by an option to extend if it is reasonably certain that the government or vendor will exercise that option

- Periods covered by an option to terminate if it is reasonably certain that the government or vendor won’t exercise that option

Recognition and Measurement

At the commencement of the subscription term, a right-to-use subscription asset—an intangible asset—and a corresponding subscription liability should be recognized. The commencement of the subscription term begins when the subscription asset is placed into service. This occurs when:

- The initial implementation stage is completed—described below.

- The government has obtained control of the right to use the underlying IT assets.

Subscription Liability

The subscription liability should be initially measured at the present value of subscription payments expected to be made during the subscription term including the following:

- Fixed payments

- Variable payments that depend on an index or a rate (such as the Consumer Price Index or a market interest rate), measured using the index or rate as of the commencement of the subscription term

- Variable payments that are fixed in substance

- Payments for penalties for terminating the SBITA, if the subscription term reflects the government exercising an option to terminate or a fiscal funding or cancellation clause

- Any subscription contract incentives receivable from the vendor

- Any other payments to the vendor associated with the contract that are reasonably certain of being required based on an assessment of all relevant factors

Future subscription payments should be discounted using the interest rate the vendor charges the government, which may be implicit in the contract. If the interest rate is not readily determinable, the government’s incremental borrowing rate should be used. Amortization of the discount on the subscription liability should be reported as an outflow of resources— interest expense.

Subscription Asset

The subscription asset should be initially measured as follows:

- Initial subscription liability amount

- Plus payments made to the vendor before commencement of the subscription term

- Plus implementation costs that can be capitalized

- Less any incentives received from the SBITA vendor at or before commencement of the subscription term

The subscription asset should be amortized in a systematic and rational manner over the shorter of the subscription term or the useful life of the underlying IT asset. Amortization of the subscription asset should be recognized as an outflow of resources—amortization expense.

Short-Term Exception

Statement No. 96 provides an exception for short-term SBITAs, which have a maximum possible term under the SBITA contract of 12 months or less. Subscription payments for short-term SBITAs should be recognized as an outflow of resources.

Implementation Costs

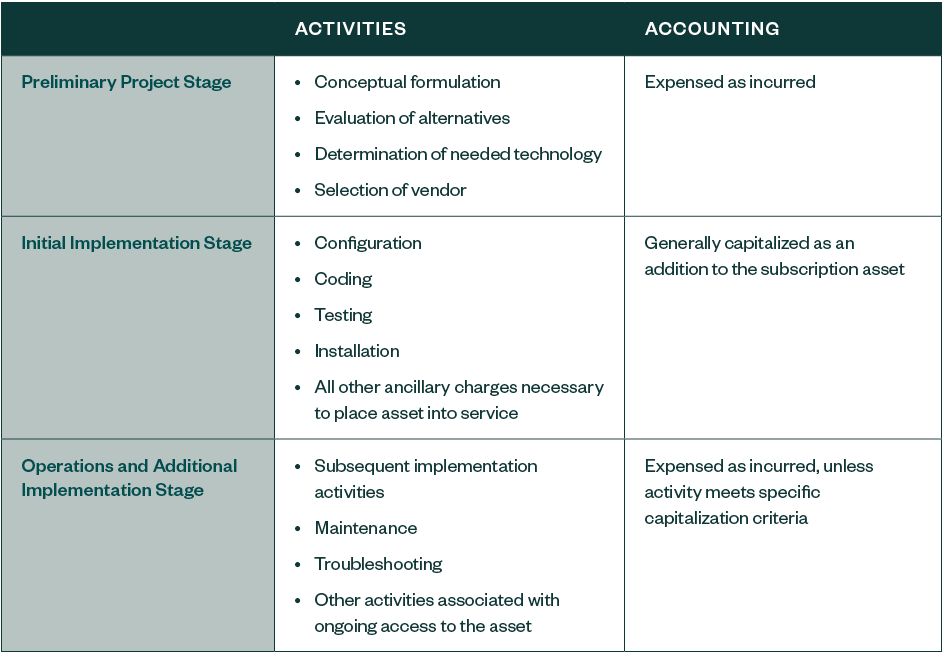

Activities associated with a SBITA should be grouped into one of three stages, detailed in the table below, and their costs should be accounted for accordingly. In classifying outlays into the appropriate stage, the nature of the activity should be the determining factor.

Training costs should be expensed as incurred regardless of the stage in which they’re incurred.

Components

If a contract contains both a subscription component and a nonsubscription component, the subscription and nonsubscription components should generally be accounted for as separate contracts.

The contract price should generally be allocated to the different components based on the stand-alone price of each component included in the contract.

Disclosure Requirements

Under the updated guidance in Statement No. 96, a government should disclose descriptive information about its SBITAs in the notes to the financial statements, including:

- General description of its SBITAs, including the basis, terms, and conditions on which variable payments not included in the measurement of the subscription liability are determined

- Total amount of subscription assets, and the related accumulated amortization, disclosed separately from other capital assets

- Amount of outflows of resources recognized in the reporting period for variable payments not previously included in the measurement of the subscription liability

- Amount of outflows of resources recognized in the reporting period for other payments, such as termination penalties, not previously included in the measurement of the subscription liability

- Principal and interest requirements to maturity, presented separately, for the subscription liability for each of the five subsequent fiscal years and in five-year increments thereafter

- Commitments under SBITAs before the commencement of the subscription term

- Components of any loss associated with an impairment

Effective Dates

The statement is effective for fiscal years beginning after June 15, 2022, and all reporting periods thereafter. Early application is encouraged.

We're Here to Help

For more information on how the new SBITA guidance may affect your organization, contact your Moss Adams professional.